Building Financial Confidence Through Real Experience

We started osperanqilo because too many capable people were stuck following advice that sounded good but didn't actually work in practice. Financial education shouldn't feel like decoding a foreign language.

Established 2023How We Got Here

Back in 2022, I was consulting with small business owners across Canberra and kept hearing the same frustration. Everyone wanted to understand their finances better, but most educational programs felt either too academic or too simplistic. There wasn't much middle ground.

So we built something different. osperanqilo grew from actual conversations with people who needed practical financial knowledge without the jargon. We focused on what actually helps someone make better decisions, not what looks impressive on a curriculum.

By early 2023, we'd developed a teaching approach that resonated with entrepreneurs who learn by doing rather than memorizing. That's still how we operate today.

What Guides Our Work

These aren't just nice words we put on the website. They're how we actually make decisions when designing programs and working with students.

Real Numbers Matter

We teach with actual case studies from Australian businesses. No hypothetical perfect scenarios that never happen in real life. You'll work with messy situations that reflect what you'll actually face.

Context Over Formulas

Financial principles change based on your industry, size, and goals. We don't pretend one approach fits everyone. Our programs help you understand when to apply what strategy.

Learning Takes Time

Building genuine financial competence isn't a weekend workshop thing. Our programs run over months because that's what it takes to develop real understanding and change how you think.

Who's Behind This

osperanqilo runs lean. We'd rather have a small team doing focused work than trying to scale beyond what we can do well. Right now, that team is mostly me, with some specialist contributors when we need specific expertise.

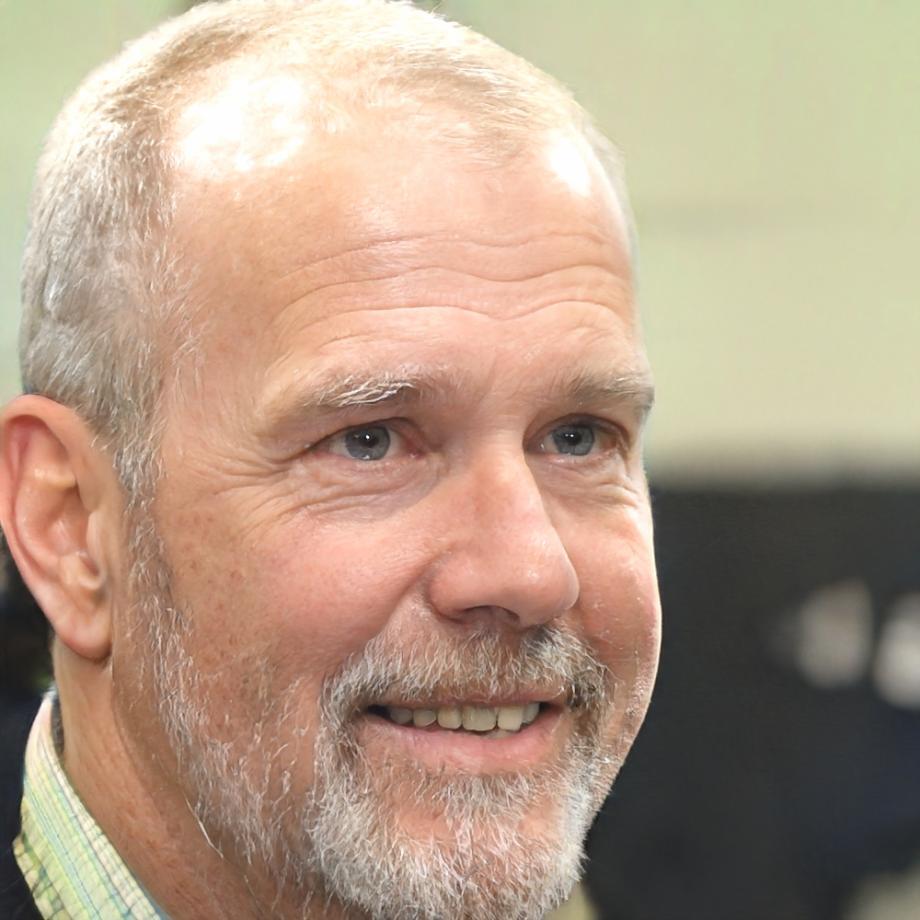

Rhys Dunworth

Founder and Lead Educator

I spent eight years working in corporate finance before realizing I was better at explaining money concepts than enjoying quarterly reporting cycles. Moved to consulting in 2019, started teaching shortly after, and launched osperanqilo in 2023.

My background is in operational finance and business strategy, which means I focus on how financial decisions actually play out in running a business. Most of what I teach comes from watching what worked and what didn't across about 40 different companies.

How We Teach

Our programs follow a specific sequence because we've found this order actually helps people build skills that stick. Each part builds on what came before.

Foundation Work

We start with how money actually moves through a business. Not accounting theory, but practical tracking and analysis. You'll set up systems that give you useful information without drowning in spreadsheets.

Decision Frameworks

Once you understand the numbers, we work on using them for decisions. Pricing strategy, investment evaluation, risk assessment. This is where financial literacy turns into financial capability.

Strategic Planning

The final phase connects financial thinking to business strategy. How to plan for growth, when to invest versus save, building sustainable operations. This takes the longest because it requires integrating everything.

Want to Know More?

Our next comprehensive program starts in September 2025. We keep groups small, usually under 15 people, so there's actual interaction rather than just watching videos. If you're curious about whether it's a good fit, get in touch and we can talk through what you're looking for.